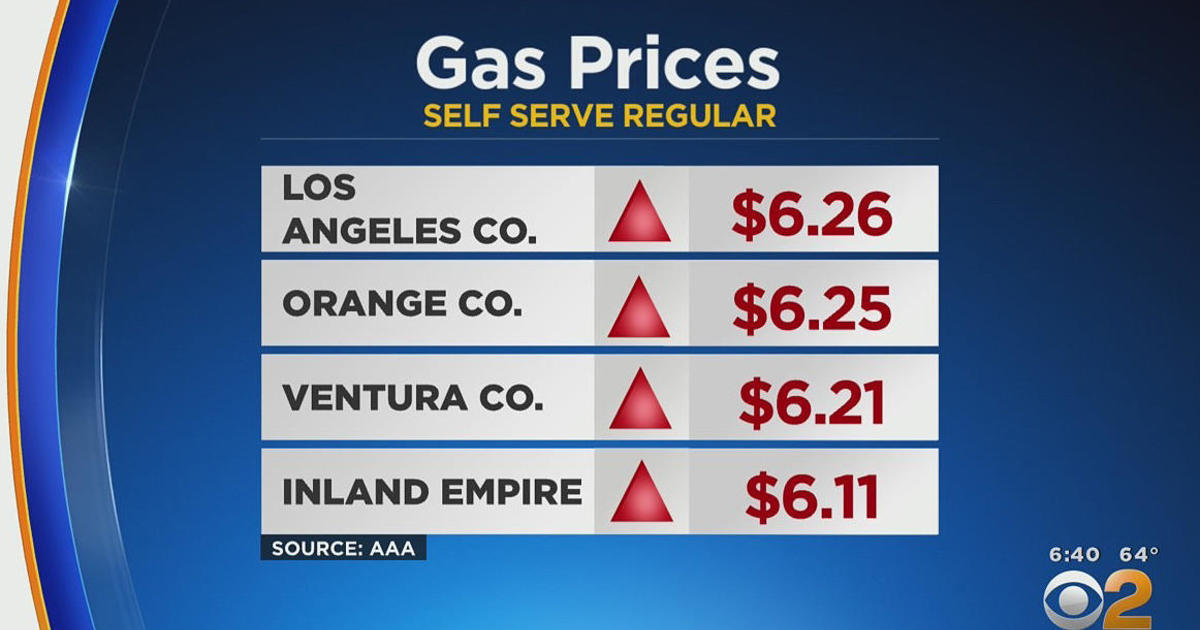

California Gas Mileage Reimbursement 2025. However, the rate for mileage reimbursement changes frequently. 21 cents per mile driven for medical or moving.

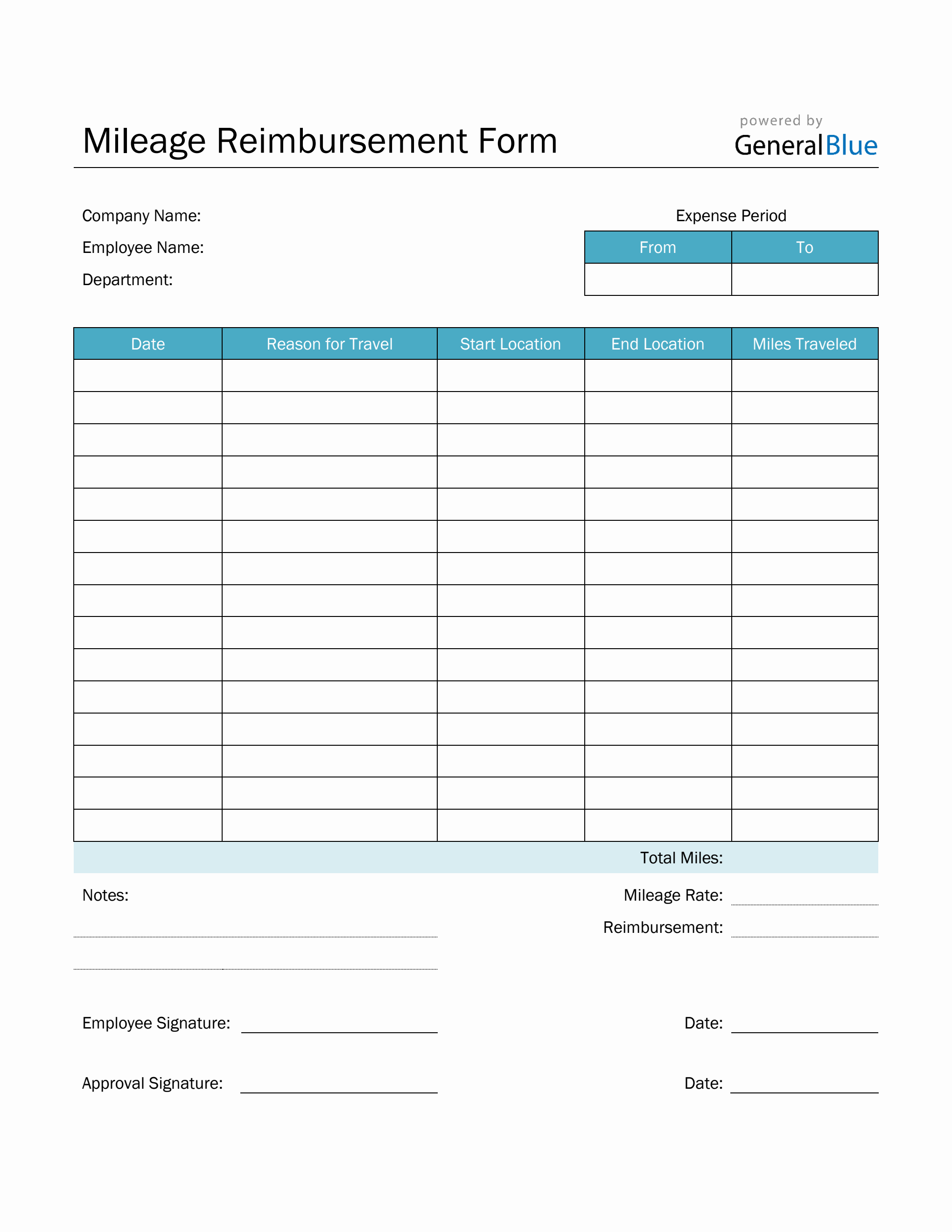

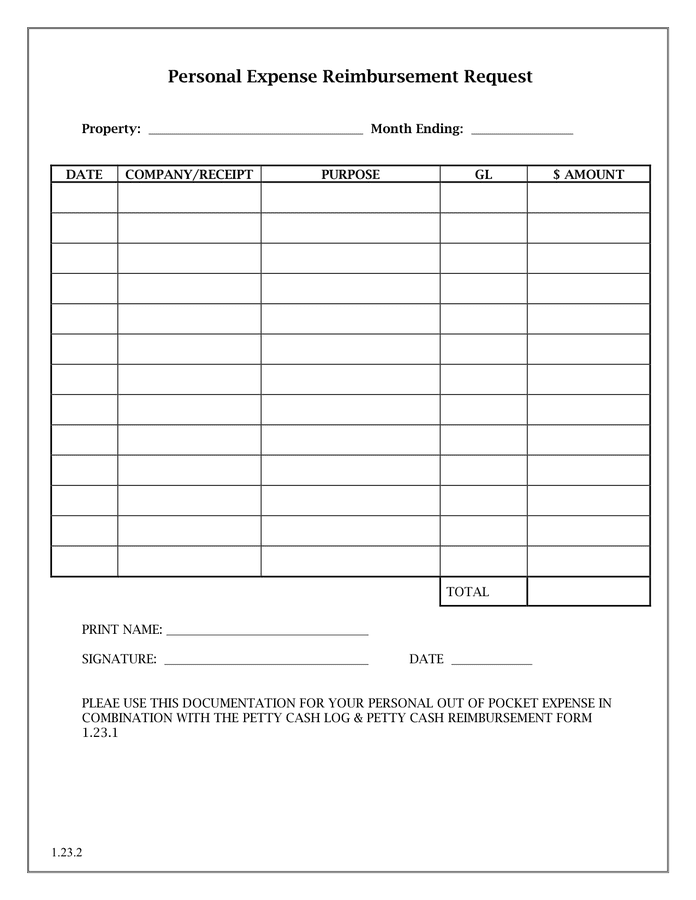

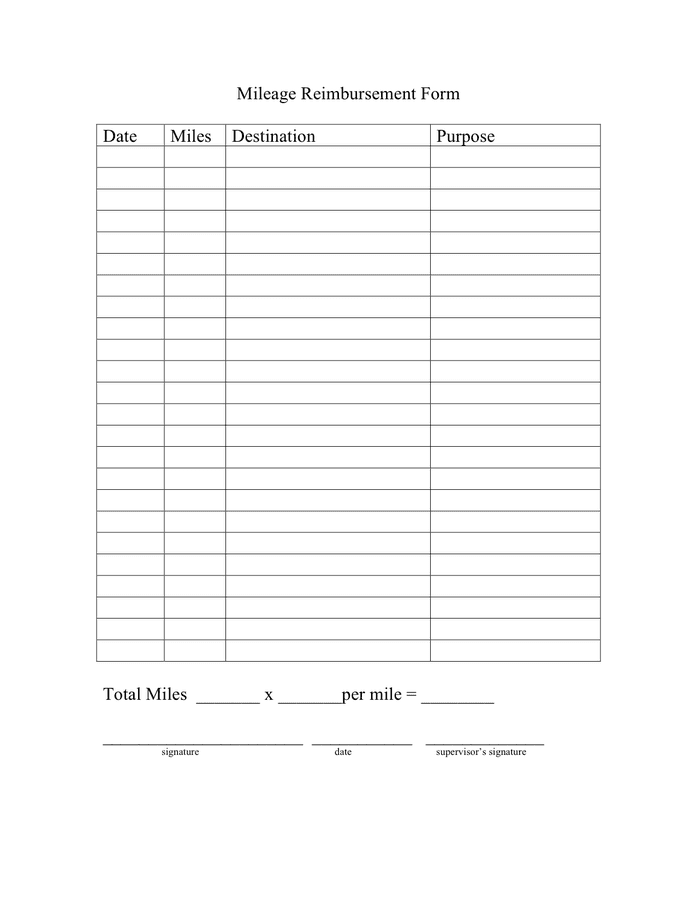

Utilizing the irs mileage reimbursement rate for your employees is smart and easy because it covers all expenses including gas, insurance, and vehicle. You can calculate mileage reimbursement in three simple steps:

2025 California Mileage Reimbursement Rate Deane Estelle, 21 cents per mile driven for medical or moving.

2025 Mileage Reimbursement Rate California Idalia Friederike, Employees will receive 67 cents per mile driven for business use (1.5.

California Gas Reimbursement Rate 2025 Melba Vickie, You can calculate mileage reimbursement in three simple steps:

2025 Mileage Reimbursement Rate California Netti Roshelle, Utilizing the irs mileage reimbursement rate for your employees is.

Mileage Rate In California 2025 Tory Ainslee, However, the rate for mileage reimbursement changes frequently.

2025 California Mileage Reimbursement Rate Deane Estelle, The standard mileage allowance (rate per mile multiplied by miles traveled) is intended to cover automobile expenses such as gas/fuel and lubrication, towing.

Mileage Reimbursement 2025 In California Faunie Kirbee, California follows the irs standard mileage rates, with the 2025 rate set at 67 cents per mile.

2025 Mileage Reimbursement Rate California Ginnie Hyacinthia, How much is gas mileage reimbursement 2025.

California Gas Mileage Reimbursement 2025 Evita, However, the rate for mileage reimbursement changes frequently.

Irs Reimbursement Rate For Mileage 2025 Livvy Quentin, What are the rules for mileage reimbursement in california?