Irs Mileage Rate 2025 California Schedule. Taxpayers use these rates to calculate the deductible costs of. So if one of your employees drives for 10 miles, you would reimburse them $6.70.

The california state university will adhere to irs guidelines for a standard mileage rate for business travel occurring on or. The internal revenue service (irs) has recently announced updates to the standard mileage rates for 2025.

The california state university will adhere to irs guidelines for a standard mileage rate for business travel occurring on or.

What Is The Mileage Rate For 2025 In California Godiva Ruthie, Our free online irs mileage calculator makes calculating mileage for reimbursement easy. The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2025.

.png)

IRS Mileage Rates 2025 What Drivers Need to Know, Beginning january 1, 2025 the standard mileage rates for automobiles. Irs issues standard mileage rates for 2025;

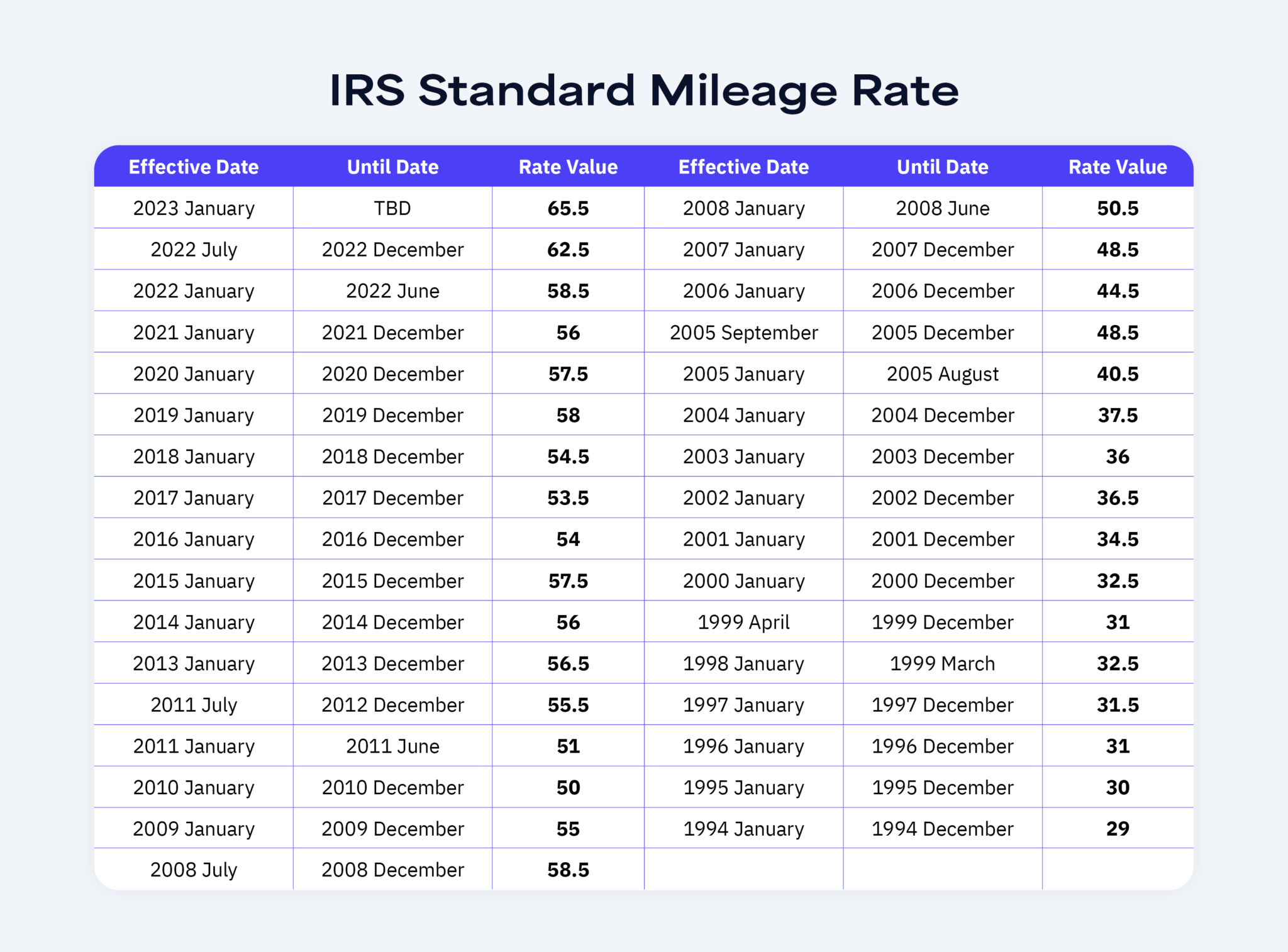

History Of The IRS Standard Mileage Rate 1994 To 2025 Cardata, The california state university will adhere to irs guidelines for a standard mileage rate for business travel occurring on or. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

Free Mileage Log Templates Smartsheet (2025), The standard mileage rates for 2025 are as follows: The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2025.

What is the IRS mileage rate for 2025 Taxfully, For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. The internal revenue service (irs) has recently announced updates to the standard mileage rates for 2025.

2025 IRS Standard Mileage Rate YouTube, Car expenses and use of the standard. The california state university mileage rate for calendar year 2025 will be 67 cents per mile, which is an increase from the 2025 rate of 65.5 cents per mile.

IRS Releases Standard Mileage Rates for 2025, This notice provides the optional 2025 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for. Taxpayers use these rates to calculate the deductible costs of.

2025 standard mileage rates released by IRS, For medical purposes and moving for active. The internal revenue service (irs) has recently announced updates to the standard mileage rates for 2025.

IRS Mileage Rate for 2025 2025 Moneywise, The standard mileage rates for 2025 are as follows: Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

IRS increases mileage rate for remainder of 2025 Local News, 17 rows page last reviewed or updated: The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2025.